Markets respond badly to slight rise in unemployment rate

Australia’s unemployment rate has increased to 5.3% seasonally adjusted as a record-high labour force participation rate of 66.2% continues to climb. Australian states are diverging in terms of labour market outcomes. South Australia, in particular, has a rapidly increasing unemployment rate, now at 7.3%. Queensland and Tasmania are at 6.4%, while NSW and Victoria both remain below 5%.

National labour force

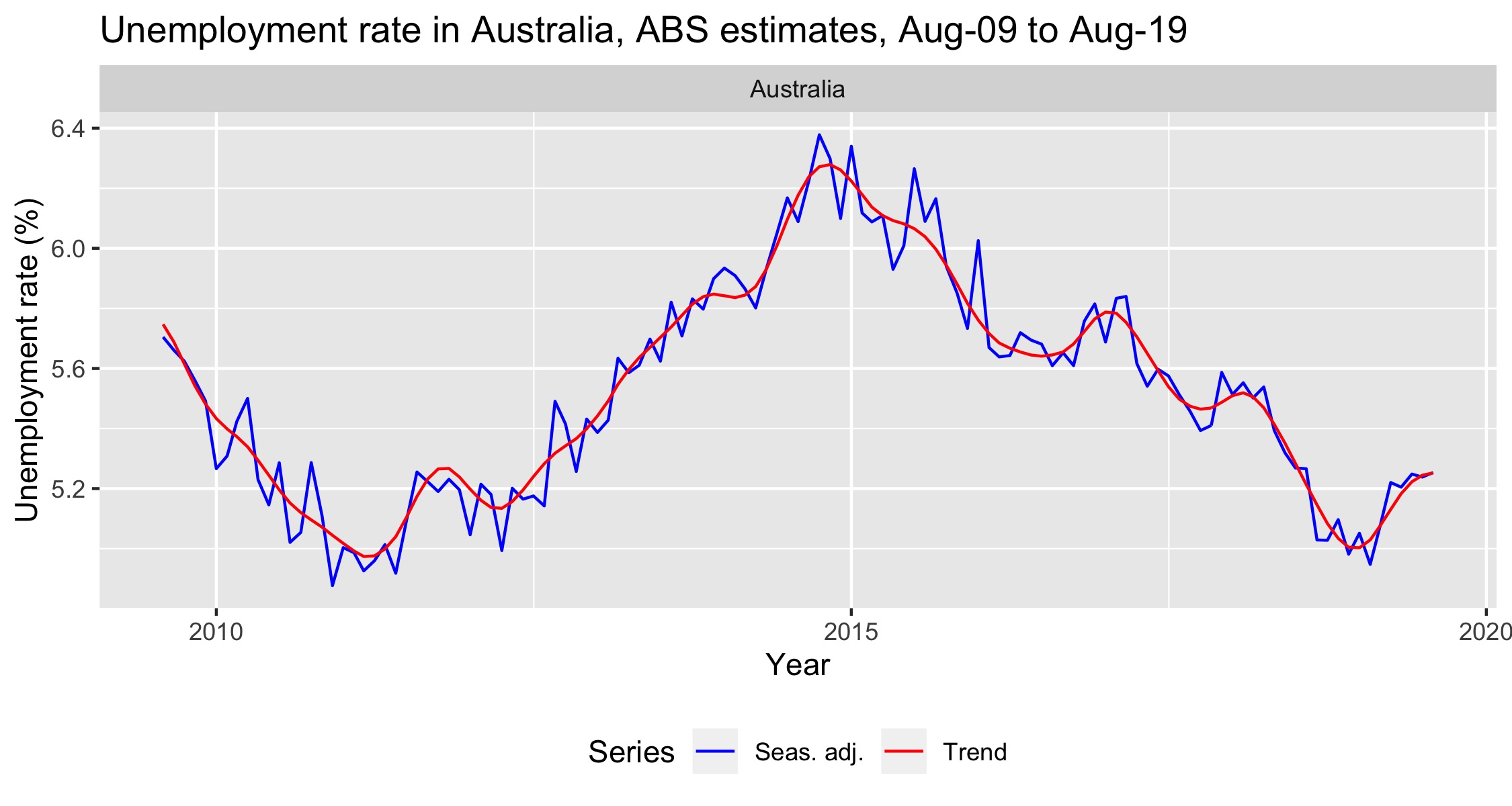

The participation rate in Australia has continued to increase and is now at 66.2%, 0.8 percentage points higher than it was this time last year.

Source: ABS LFS August

This record-level participation rate may explain the marginal rise in Australia’s unemployment rate, which has grown by less than 0.1% to 5.3%.

Source: ABS LFS August

State labour force

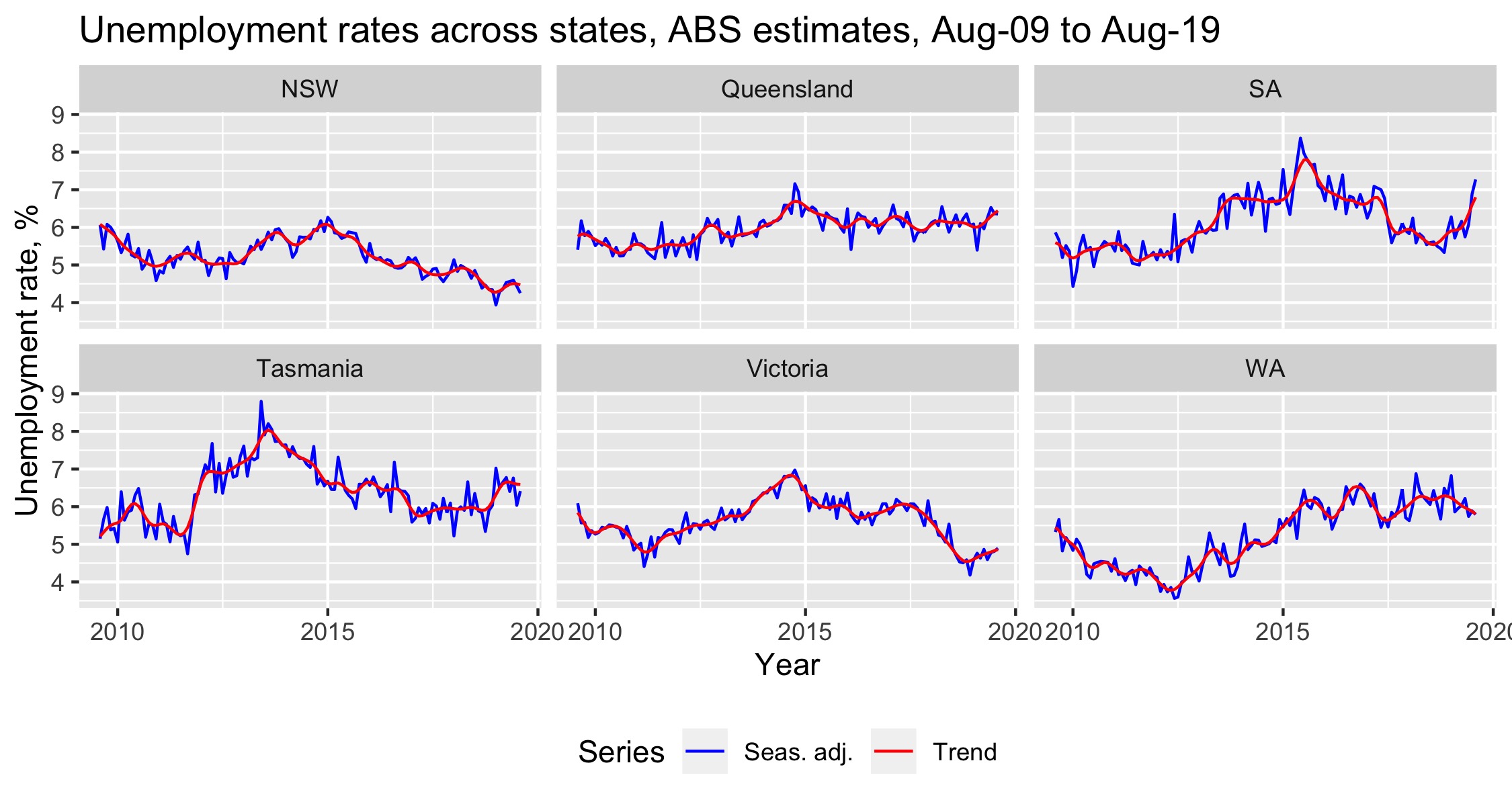

The unemployment rate has continued to increase in SA and has now reached 7.3%. Although SA’s decade-high unemployment rate of 8.5% is still a fair distance away, the state is up 1.7 percentage points in this respect with regard to this time last year. Things aren’t much better in Queensland, which is currently sitting in second place with Tasmania at 6.4%.

Source: ABS LFS August

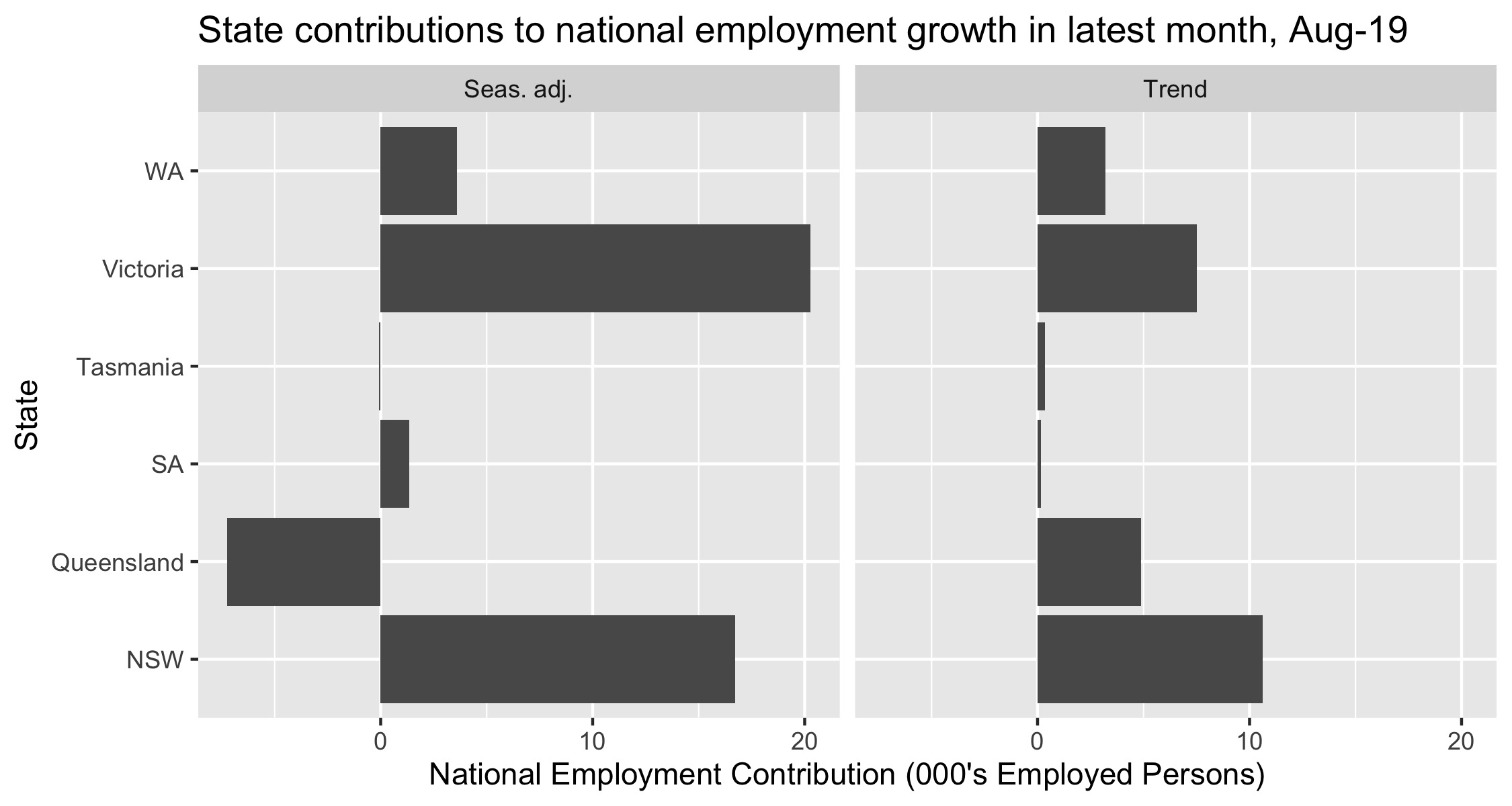

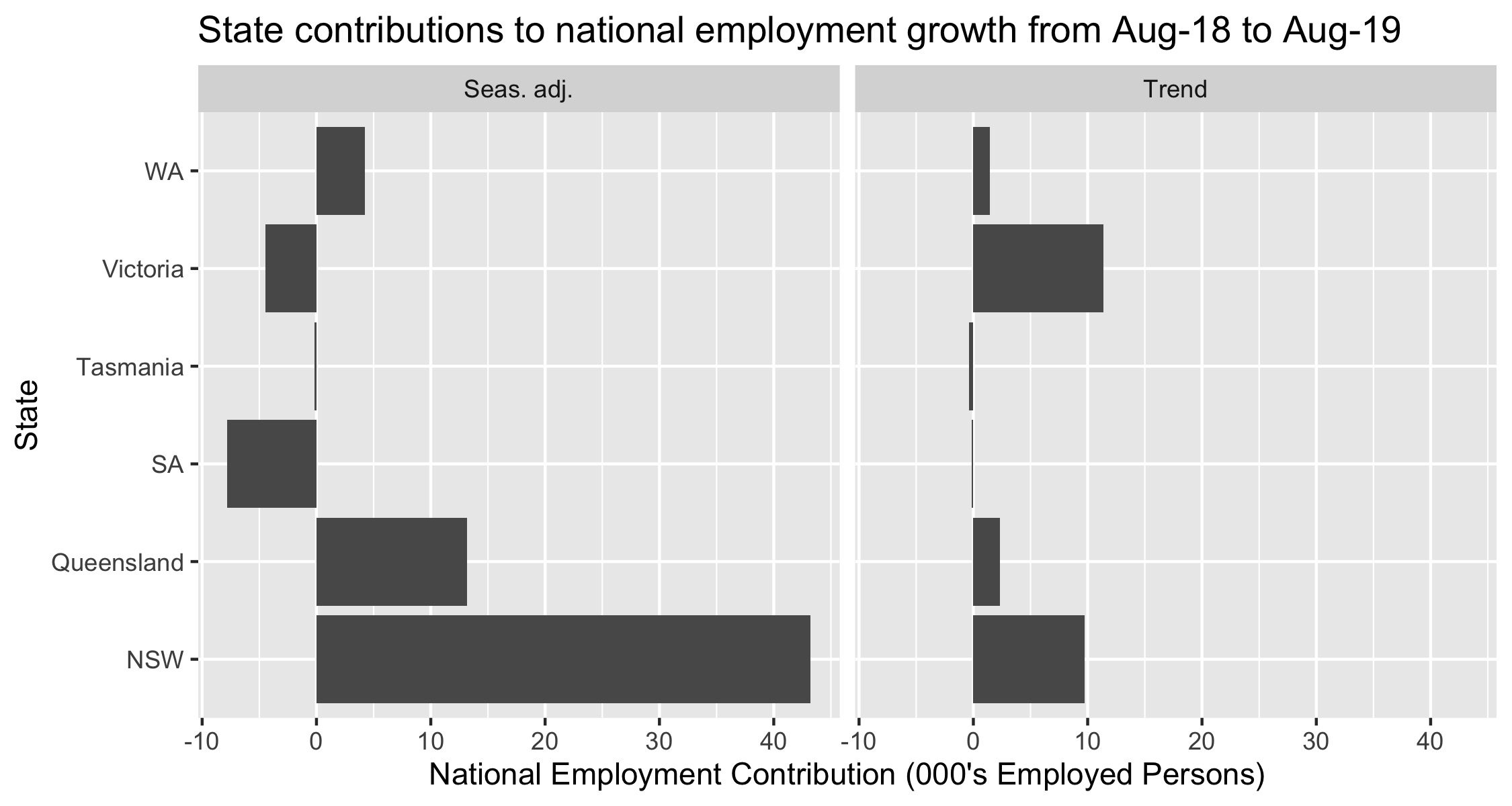

Potentially concerning for Queensland is the loss of 12,000 jobs, in seasonally adjusted terms, over August. From a yearly vantage point, however, Queensland is up by around 12,000 jobs with respect to this time last year.

Source: ABS LFS August

Source: ABS LFS August

Summary

The market reacted badly to today’s data. At 1630 AEST, the Australian dollar has fallen by 0.6 per cent against the US dollar to a low of $0.6787, its lowest since September 4.

Despite rising by less than 0.1%, the unemployment rate’s increase from 5.2% to 5.3% was enough for the market to reflect growing uncertainty in Australia’s economy. Whether or not this response was appropriate remains to be seen. The August RBA Statement on Monetary Policy, for one, forecasts the national unemployment rate to persist at around 5.2% before beginning to fall marginally in June 2021 as GDP growth is expected to pick up.

It is clear that the market is keenly watching for any confirmation of a deteriorating economy after Australia experienced its slowest rate of GDP growth since the 2008 GFC in the June quarter. Time will tell.

This article was prepared by Ben Scott, Research Assistant, and Gene Tunny, Director, of Adept Economics. Please get in touch with any questions or comments to ben.scott@adepteconomics.com.au.