Retail Apocalypse in Australia?

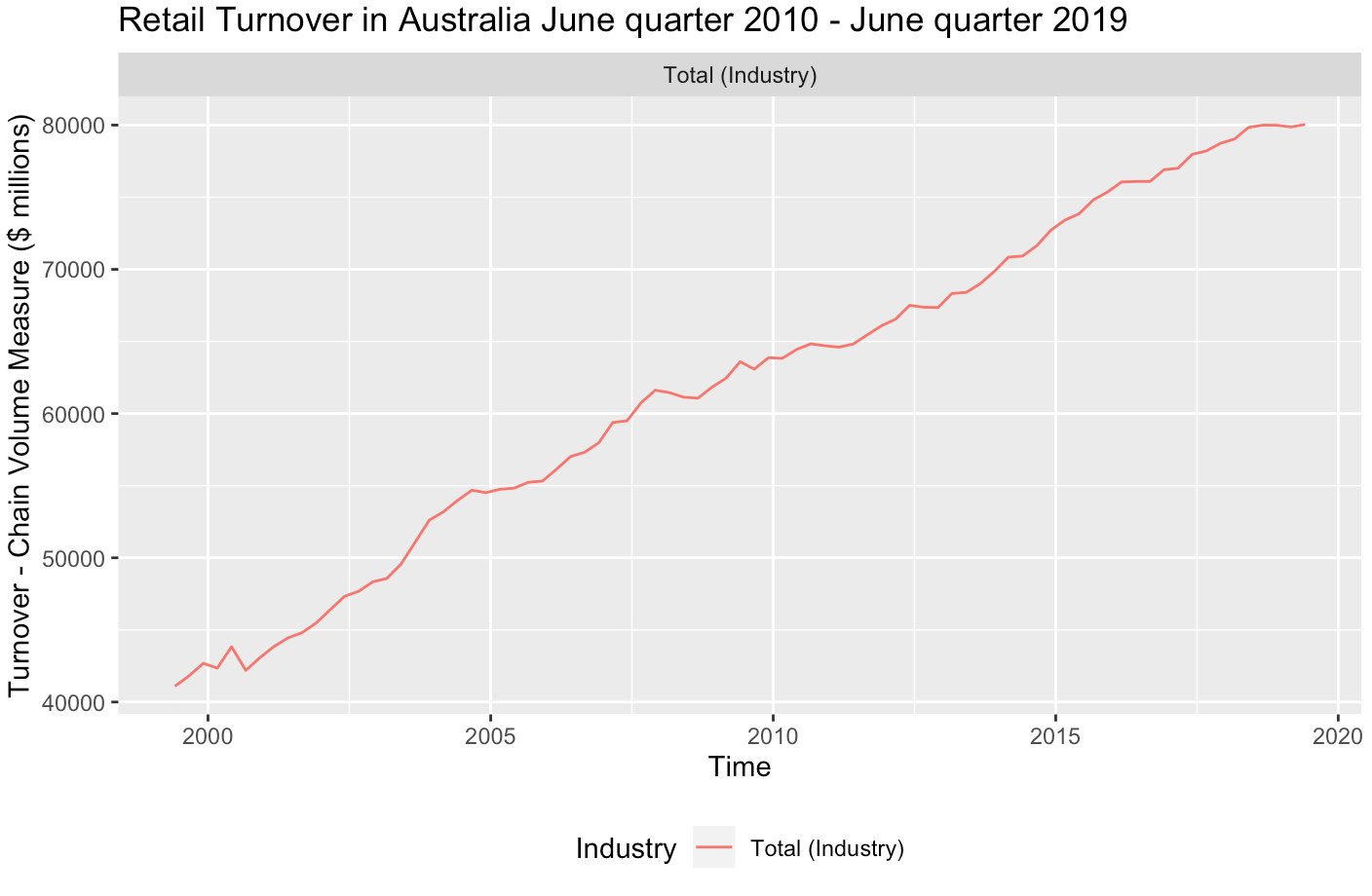

Over much of the past decade, Australia’s retail industry had enjoyed sustained and steady growth. Despite a few dips along the way, retailers, for the most part, were unaffected by negative economic factors. However, since mid-2018, the Australian retail trade has been flat-lining (see chart below).

Source: ABS Retail Trade Statistics. All data are seasonally adjusted.

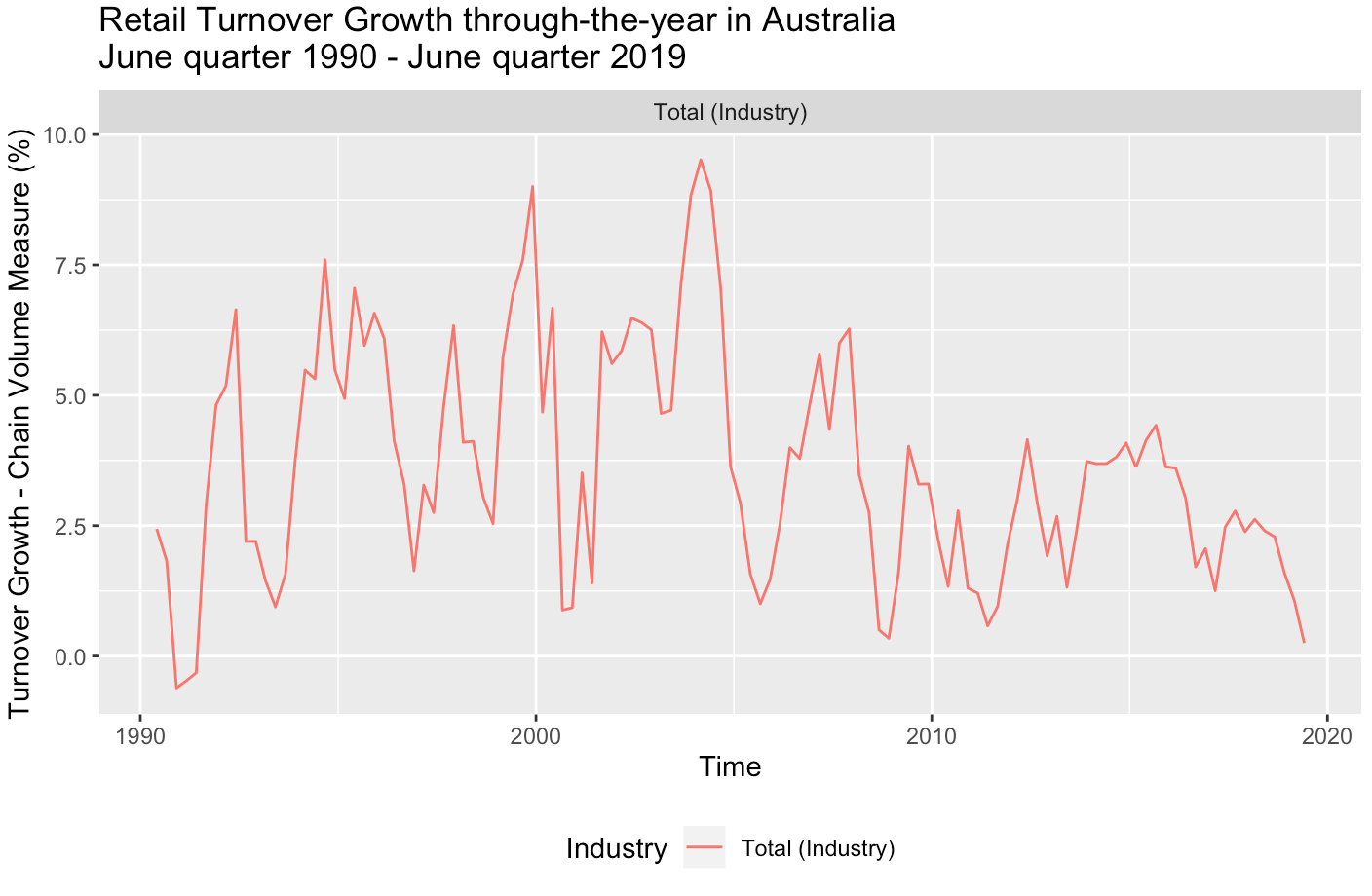

The retail industry is currently experiencing its biggest growth slump in over two decades, according to ABS estimates. The meagre 0.2% real growth in turnover through-the-year in June quarter 2019 is even worse than the sector’s through-the-year growth during the 2008 global financial crisis. The Sydney Morning Herald pointed out today that retail sales have dropped to levels not seen since the 1991 recession (see chart below).

Source: ABS Retail Trade Statistics. All data are seasonally adjusted.

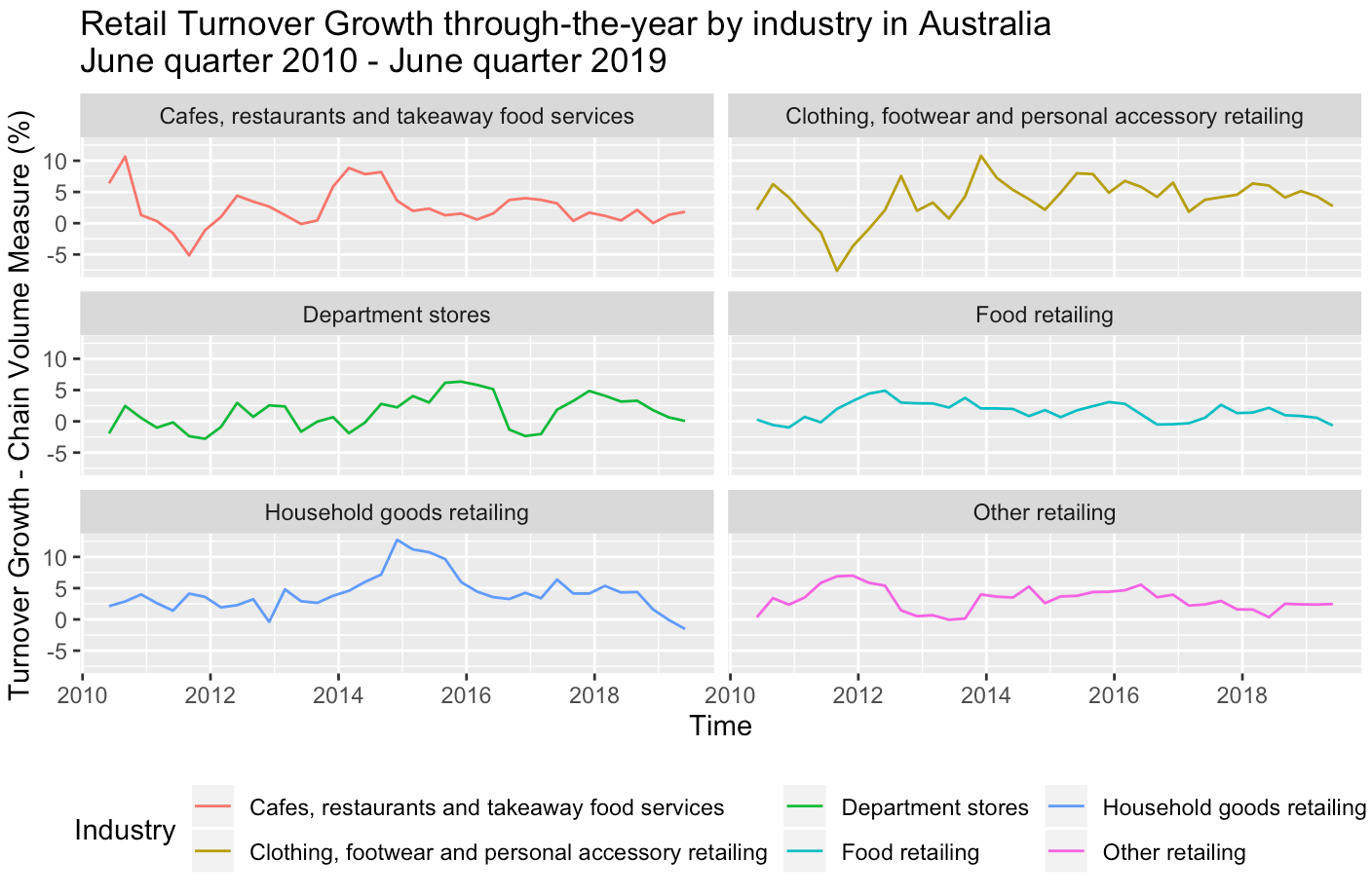

Performance is poor across multiple retail industry groups. The cafe, restaurants and takeaway food service, and other retailing industries are the only two that are both rising and above 0% growth. The growth in cafes, restaurants and takeaway food services likely reflects both our ever-growing cafe culture and strong growth in food delivery services such as Uber Eats and Deliveroo. Other retailing includes e-commerce, which is adversely impacting bricks-and-mortar retailing worldwide. The clothing, footwear and personal accessory retail industry has enjoyed healthier growth, of 2.5% through-the-year to June quarter, but its growth rate is falling at a substantial rate (see chart below).

Source: ABS Retail Trade Statistics. All data are seasonally adjusted.

The main explanation of the flatlining retail sector is that Australian households are feeling the pinch from slow wage growth and job security concerns. Insolvencies and bankruptcies may be down from last year, but it is becoming increasingly apparent that Australians are being more cautious with their spending than in previous years.

If slow growth in household consumption spending continues to affect the retail sector, Australia’s very own “retail apocalypse” could well be on its way. Indeed, the Business Insider expects 8,200 Australian stores to close in 2019. This could have a substantial impact on Australia’s overall economic performance, as retail trade is the nation’s second-largest employing industry.

Not everyone is pessimistic about the retail sector. The Australian has reported that Carmel Hourigan, global head of property for AMP Capital, has highlighted the need for retail hubs to “keep evolving”. They can do this by becoming “social infrastructure-style businesses” and “community hubs rather than traditional shopping points”. While acknowledging high vacancy rates in many malls worldwide, Hourigan is convinced that shopping centres can endure the current downturn and take on new tenants such as health and education providers, which can expect growing consumer demand over the long-term.

Perhaps this is the case, but even so, there is no doubt that Australia’s retail trade sector is stuck in a rut. In his comments regarding NAB’s Monthly Business Survey for July 2019, NAB Chief Economist Alan Oster described the sector’s situation as “reaching recessionary levels”, with little indication of potential improvement in the near future.

This article was prepared by Ben Scott, Research Assistant, and Gene Tunny, Director, of Adept Economics. Please get in touch with any questions or comments to ben.scott@adepteconomics.com.au.